iProov Uncovers Dark Web KYC Bypass Operation

/ 3 min read

Quick take - iProov’s recent report reveals a dark web operation in Latin America that exploits genuine identity documents to bypass Know Your Customer (KYC) verification processes, raising concerns about identity fraud and the integrity of verification systems.

Fast Facts

- iProov’s report reveals a dark web operation in LATAM that bypasses KYC verification using genuine identity documents and facial images, raising concerns about identity verification integrity.

- Individuals may willingly provide their identity information for payment, indicating a shift in personal data compromise methods.

- Risks include increased phishing attacks, data breaches, impersonation fraud, erosion of trust in identity verification, and higher operational costs for organizations.

- Experts recommend a multi-layered verification approach, including document verification, real-time checks, and managed detection practices to combat these threats.

- Law enforcement in LATAM has been alerted to the operation, with similar activities noted in Eastern Europe but without confirmed connections.

iProov Uncovers Dark Web KYC Bypass Operation

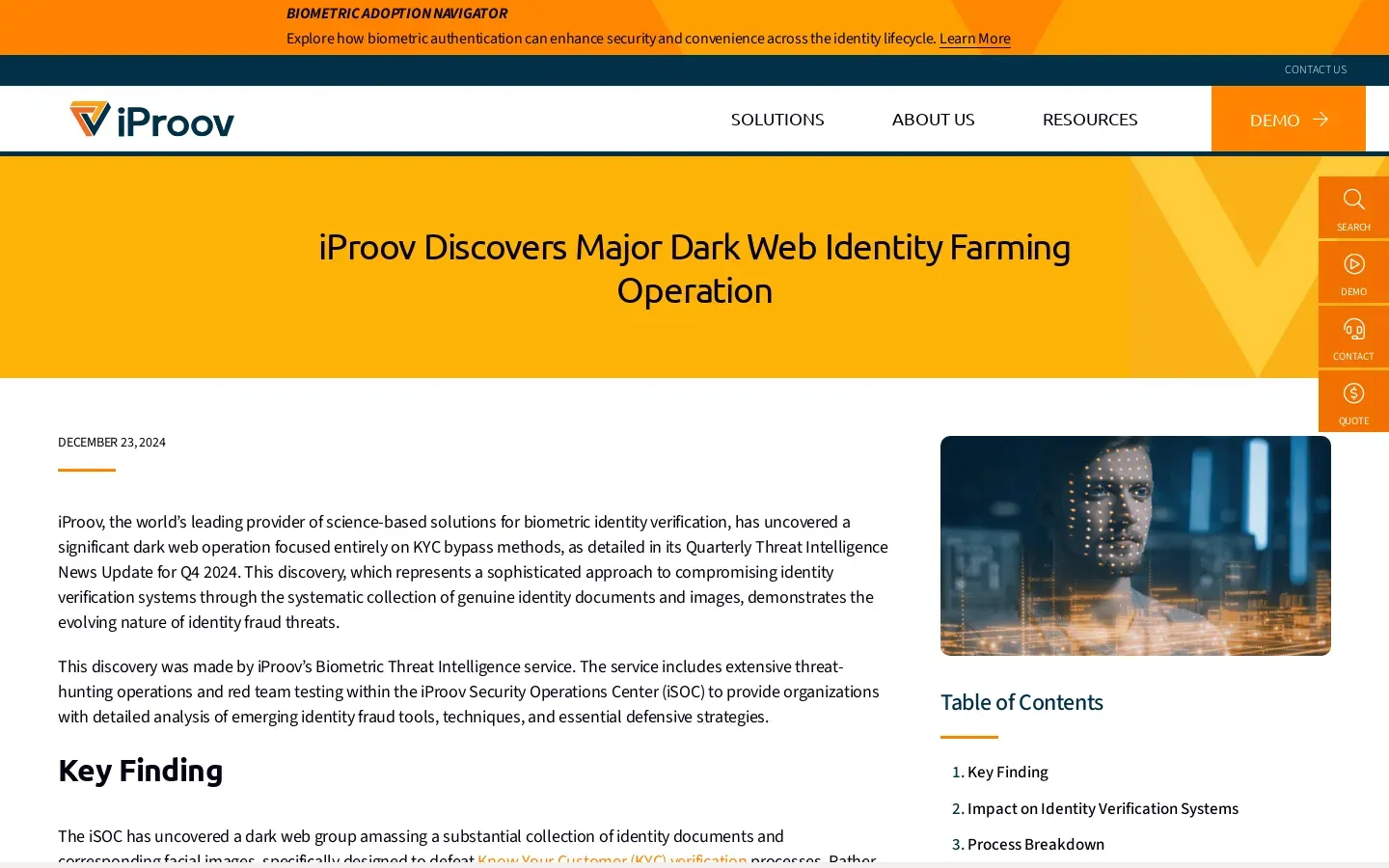

In a recent revelation, iProov, a leader in biometric identity verification technology, has uncovered a significant dark web operation aimed at bypassing Know Your Customer (KYC) verification processes. Detailed in their Q4 2024 Quarterly Threat Intelligence News Update, this operation highlights serious vulnerabilities within identity verification systems and raises alarms about potential increases in fraud.

Key Findings

The investigation by iProov reveals that a group primarily operating in the Latin America (LATAM) region has accumulated a trove of genuine identity documents and facial images. These materials are exploited to circumvent KYC processes, which are essential for verifying identities in financial transactions and other sensitive activities. Alarmingly, it appears that some individuals may have willingly exchanged their identity documents and images for payment. This marks a shift from traditional data theft methods, highlighting a new trend in personal data compromise.

Parallel patterns of activity have been detected in Eastern Europe, though no direct links to the LATAM operation have been established. In light of these findings, law enforcement agencies in the LATAM region have been notified about the potential threats posed by this operation.

Implications

The availability of genuine identities presents several risks:

-

Phishing Attacks: With access to real identity information, attackers can craft highly convincing phishing schemes targeting both individuals and organizations. This increases the likelihood of successful attacks, potentially leading to significant financial loss and data compromise.

-

Data Breaches: The exploitation of authentic identities could facilitate data breaches, allowing malicious actors to access sensitive information stored within systems relying on KYC verification.

-

Impersonation Fraud: Genuine identity packages enable criminals to engage in sophisticated impersonation fraud, potentially resulting in substantial financial damages for both individuals and businesses.

-

Erosion of Trust in Identity Verification: The sophistication of these attacks threatens public trust in identity verification systems. As confidence diminishes, individuals may become increasingly hesitant to use such services, complicating matters for businesses and financial institutions dependent on KYC processes.

-

Increased Operational Costs: Organizations might face heightened operational costs as they invest in upgraded identity verification systems to counteract these sophisticated threats. This includes implementing advanced technology and ongoing monitoring to ensure compliance and security.

Recommendations for Mitigation

To address these evolving threats, experts recommend adopting a multi-layered verification approach:

- Confirm identities by matching presented documents with official records.

- Ensure real person involvement through analysis of embedded imagery and metadata to detect malicious media.

- Utilize real-time verification methods with unique challenge-response mechanisms to enhance security.

Organizations are also encouraged to engage in managed detection and response practices to swiftly address potential breaches or fraudulent activities.

As the landscape of identity verification evolves amidst these emerging threats, it is crucial for businesses and individuals alike to remain vigilant and proactive. Safeguarding personal information and enhancing verification processes will be key in navigating this challenging environment.